My colleague and I went shopping for a car last week. He liked the car and decided to pay for the booking fee. As he didn’t have a credit card, I offered to pay for him. The booking fee costs $16,000 thus I have to split payment between 2 cards. The first card I used was the Manhattan Card. It gives me a cash rebate of 5% on spending, with a cap of $300 every quarter. Good choice, I just earned $300.

As I rarely use my cards, SCB sent a mailer saying that I qualify for a 5% retail rebate, up to a cap of $50 for my purchases. Coincidentally, I earned another $50.

The Xtra Saver card gave me another 0.5% on NETS payment (cap at $50). Hence I will be using the Xtra Saver card to pay my Manhattan Card bill ($8,000). This gives me $40 cash back.

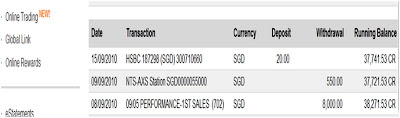

My total gain was $550, for helping my colleague out. He transferred the money back to me this morning.

I did not do my “homework” on which card to use before going shopping but when I came back and search the web on the “best credit card” to use for the $16,000 purchase, it turned out that no matter how many points you chalk up, the returns can hardly be as good as the above combination.

The best combination, perhaps is to use 3 different (holders of) Manhattan cards to clock a $800 rebate ($16,000x5%) plus paying 3 cards using Xtra Saver NETS ($80 rebate) which gives a grand total of $880.

However, it will be too much of a hassle to do that. Currently, even with American Express 100% bonus points or SCB Visa Infinite 2.5x points system, the total vouchers value will not be close to $300. Don't even bother about airmiles or POSB everyday card's 0.3% cash rebate.

Typically, credit card gives 0.5% rebates in voucher values on spending. For example if I spend $10,000 on the card, I can redeem around $50 of vouchers. Even with 3x points on spending, I can only get $150 of vouchers. This is a far cry from pure 5% cash rebates from Manhattan Card.

The only drawback for Manhattan Card is that it only gives 5% rebates when spending exceeds $3,000. But readers can consider using this card to pay your annual insurance premiums, wedding banquet or any other purchases that exceeds $3,000. Do not be fool by marketing gimmicks of 2x or 5x points. They are at most 1% to 2.5% rebates of your spending.

No comments:

Post a Comment