WallStreet Journal

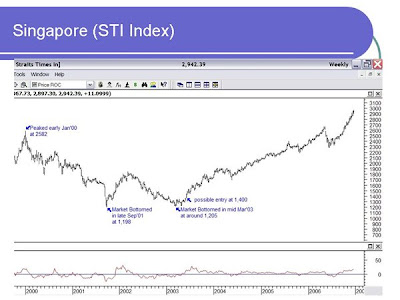

When you bought into the gospel of "stocks for the long run," did you have any idea how long the long run can turn out to be? Exactly 10 years ago, the Standard & Poor's 500-stock Index was at 1164; it closed Friday at 1239. That's an annualized average return of 0.63%. At that rate, it will take you 111 more years to double your money in the stock market.

Meanwhile, this newspaper, and most of Wall Street, has declared that stocks have officially entered a bear market now that the Dow Jones Industrial Average is 20% below its record high of last October. I think that's poppycock. We've been in a bear market for years; the Dow was almost 600 points higher in early 2000 than it is today. What about that 10% yearly return that U.S. stocks supposedly provide with near-certainty? To earn a 10% long-term return, according to Morningstar, you need to have bought at least 19 years ago and held on ever since.

Could things possibly get worse? I don't know, but I am an optimist -- so I certainly hope things do get worse. Nothing else should satisfy an intelligent investor.

This May, at the annual meeting, boiled down what it means to be an intelligent investor into two startling sentences: "If a stock [I own] goes down 50%, I'd look forward to it. In fact, I would offer you a significant sum of money if you could give me the opportunity for all of my stocks to go down 50% over the next month." Knowing he owns good businesses, Mr. Buffett wants prices to go down, not up, so he can buy even more shares more cheaply before the bounce back.

In the last long bear market, 1969 to 1982, stocks returned just 5.6% annually; after inflation, investors lost more than 2% a year. That mauling by the bear made stocks so inexpensive that over the ensuing 18 years they went up 18.5% a year, enough to turn $10,000 into more than $200,000.

The people who so far this year have yanked $39 billion out of U.S. stock funds, and $6 billion out of exchange-traded stock funds, do not understand this. But if you are still in your saving and investing years, a bear market is a gift from the financial gods -- and the longer it lasts, the better off you will be. Instead of running from the bear, you should embrace him.

This new column takes its name from the classic book by Benjamin Graham, who wrote that "the investor's chief problem -- and even his worst enemy -- is likely to be himself." I hope to help you understand the chaotic markets around you, and the even more treacherous enemy within. For, as Mr. Buffett has also pointed out, investing is much like dieting: It is simple, but not easy. Everyone knows what it takes to lose weight. (Eat less, exercise more.) Nothing could be simpler, but few things are harder in a world full of chocolate cake and Cheetos.

Likewise, investing is simple: Diversify, buy and hold, keep costs low. But simple isn't easy in a market seething with "free" online trades, funds that promise to transform losses into gains, and TV pundits who shriek out trading advice as if their underpants were on fire. The real secret to being, or becoming, an intelligent investor is bolstering your self-control.

So, in these columns, I will seek to combine the wisdom we can glean from Graham with the latest insights from psychology, neuroscience and behavioral economics. The result, I hope, will be practical advice that can increase your odds of reaching your financial goals.

For now, bear this in mind: That which does not kill investors makes them stronger. Physiologists have shown that minuscule doses of poison may actually make organisms (including humans) healthier, a phenomenon called hormesis. I do not recommend seasoning your food with cyanide.

But the findings on hormesis do remind us that painstaking investors -- literally, those who can take the pain of a bear market that seems to drop another 1% every day -- will ultimately triumph, by patiently amassing greater and greater equity positions at better and better prices. The ancient King Mithridates of Pontus is said to have made himself immune to poison in constant gradual doses, a tale retold by the poet A.E. Housman:

They put arsenic in his meat And stared aghast to watch him eat; They poured strychnine in his cup And shook to see him drink it up.... I tell the tale that I heard told. Mithridates, he died old.

Sgbluechip says: I think the worst thing to do now is to sell away your holdings. The lower it goes, the nearer we are to the bottom.

I seldom blog on investment books’ review as it is too subjective at times to objectively pen down my thoughts. After all, the wisdoms I extract from any book have to be complimented with my actual life experiences before it integrates and forms part of me. In a nutshell, how I perceive investment and life after digesting the books may only be relevant to I, me and myself only.

I seldom blog on investment books’ review as it is too subjective at times to objectively pen down my thoughts. After all, the wisdoms I extract from any book have to be complimented with my actual life experiences before it integrates and forms part of me. In a nutshell, how I perceive investment and life after digesting the books may only be relevant to I, me and myself only.